Result, return and assets 2020

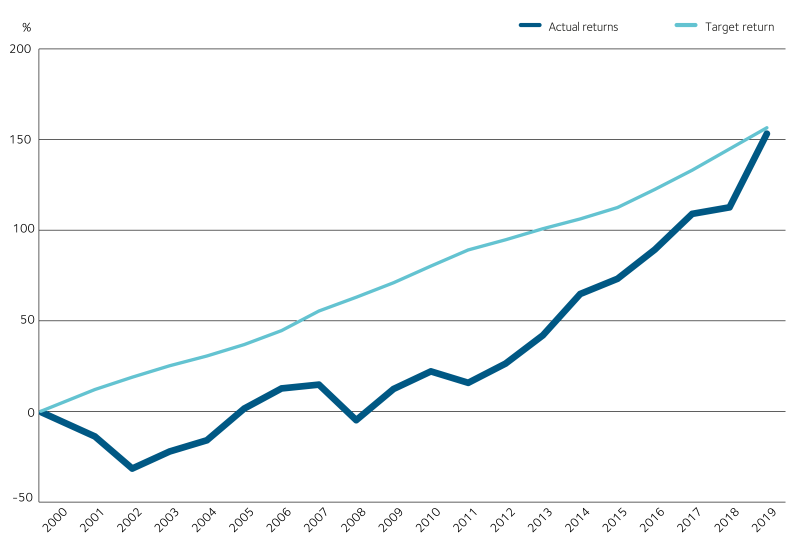

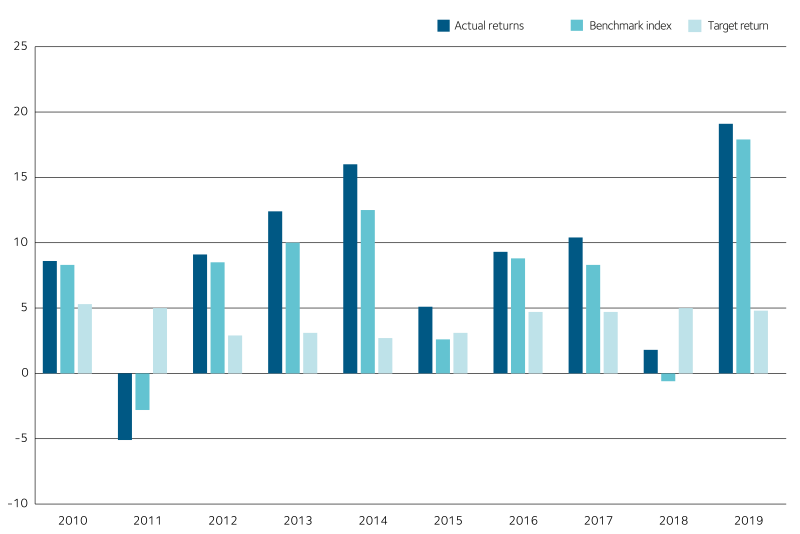

The result for 2020 for the Church of Sweden's asset management at the national level amounted to SEK 403 million. This corresponds to a return of 4.2% (benchmark index 5.0%).

After eight years in a row where the return exceeded the weighted reference portfolio’s benchmark index, the return for 2020 was slightly lower than this index, i.e. 0.8 percentage points.

The main reason for this development in 2020 is the continued overweight we had in global equities compared to Swedish equities, in combination with an increasingly stronger Swedish Crown during the year. When the value of our global equity mandate is converted to Swedish Crowns for 2020, the return has been significantly below the return in the Swedish equity portfolio.

The market value of the assets invested as of 31 December 2020 amounted to SEK 9,909 million (previous year SEK 9,626 million). In December, a withdrawal of SEK 120 million from the portfolio at the Church of Sweden’s national level was made for the purposes of liquidity management.

Allocation based upon a strategic reference portfolio

To create pre-requisites making it possible to achieve the long-term target we use a strategic reference portfolio that we then also use as a reference portfolio when evaluating our asset management against the ten-year time horizon.

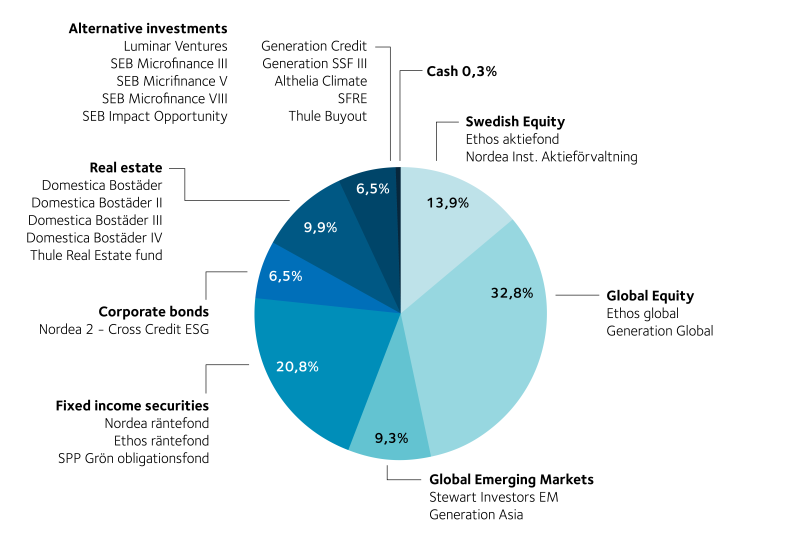

Depending on how the different markets develop, the distribution, i.e. allocation, among the asset classes in our portfolio, is constantly changing.

The allocation between the asset classes is shown in Figure 4, the return per asset class, Table 1 and the largest shareholdings in Table 2.

Equity management

Equity management contributed with SEK 315 million net. Ethos' Equity Fund, which is managed by SEB, had the highest return among Swedish equities, with 17.3% (index 14.8%). Generation IM Global Equity Fund had the highest return among global equities and emerging markets with 5.9% (index 1.9%). The managers in the asset classes global equities and emerging markets as a group performed considerably higher than their respective benchmark indices (1.6 and 1.4 percentage points, respectively). Swedish equities as an asset class, on the other hand, was 3.8 percentage points lower than the index.

Fixed income investments

Swedish fixed income management yielded a 1.7% return, which is 0.4 percentage points higher than the index. Falling interest rates were the main reason why the index for Swedish interest rates rose by 1.3% during the year.

Corporate bonds, especially in the slightly higher risk segments, were hit hard in the initial phase of the pandemic resulting in negative price development and poor liquidity.

Real estate

The real estate asset class contributed with a 6.7% return (index 3.5%). However, the return is largely based on annual, external valuations of the holdings in the various real estate funds in which we have invested. These valuations are made annually but are often determined well into the first quarter, which is why there is a lag of one year in valuation development. The return for the 2020 result therefore includes the valuation as of 31 December 2019.

Alternative investments

Alternative investments yielded a negative return of 3.3%, which is significantly lower (6.8 percentage points) than the absolute return index on the KPI + 3% we use for properties and alternative investments. As inflation (KPI) ended up at 0.5% for 2020, the index became 3.5%. The majority of the holdings in the asset class showed red figures for 2020. A large part of this can be explained by a stronger Swedish Crown, especially against the US dollar. As previously stated, however, the current valuation of primarily equity-related investments, and to a large extent also illiquid assets, can often be associated with a great degree of uncertainty. In the vast majority of our holdings within this asset class, one has to wait until maturity before the result can be determined.

Back to the table of contents

.png?DoProcessing=&w=800)

%20(1).png?DoProcessing=&w=800)

%20(1).png?DoProcessing=&w=800)

.jpg?doprocessing=1&w=164&c=95&ci=195,0,737,921)