This is the ninth year in a row that the Church of Sweden has published a report on its work with sustainability issues in asset management at the national level. The report has been produced by the financial staff after consultation with the Central Board Asset Management Council. Asset management in dioceses, parishes and congregations are not included in this report.

Sustainable investments 2019

Performance in 2019 including bank and management fees amounted to SEK 1 582 million (SEK142.9 million the previous year) Returns for the overall portfolio amounted to 19.1 per cent (1.8 percent). This is 1.2 percentage points better than our benchmark index and 14.3 percentage points higher than the real rate of return target.

Introduction - The year in brief

Subsequent to the weak conclusion of 2018 with sharply falling markets and rising interest rates, the expectations for the 2019 were very low. Instead, 2019 turned out to be one of the strongest years on the global markets since the turn of the century. Economic development exceeded expectations at the same time that an easing of monetary policy once again contributed to a strengthening of the market.

Asset management’s performance, amounting to SEK 1 582 million, is the highest since the portfolio was taken over by the Church of Sweden in 2000. Returns were 19.1 per cent and this means that asset management is now entirely on track in regard to long-term target return established in 2000.

During 2019, the UN Climate Change Conference (COP 25) took place in Spain, after having been moved from Chile where protesters raged against the growing inequality in society. The outcomes of the negotiations were meagre and hope for more concrete results were shifted to the next meeting in Scotland. On a positive note, however, Ursula von der Leyen, the EU Commission’s new chairwoman, presented a new green deal based on society becoming greener and cleaner for the benefit of the economy, health and nature.

To be able to reach the climate and energy targets for 2030 a further €260 billion per year in investment is needed, corresponding to 1.5 per cent of GDP. The private sector will be invited to participate in this through a strategy for green investment that will be put forth during 2020. We are also going to learn more about how the EU’s new framework for green bonds and the classification of what can be called a green bond, the so called taxonomy, will affect the entire financial sector. Read more here.

The prolonged and widespread fires in Australia and California during the year have caused extensive damage and led to far-reaching costs. These events led to the realisation among many of us that we are very vulnerable to the effects of an increasingly instable climate. Upon writing (March 2020), as the Corona Virus is paralyzing a number of countries leading to quarantines and travel restrictions, the equities markets are riding a roller coaster and central banks as well as governments are issuing new advisories daily, we are clearly reminded of the financial market and society’s sensitivity as a whole to black swans.

Commission, Asset Management Model and Follow-up

The commission given to us by the Central Board of the Church of Sweden places clear focus on the long-term performance of asset management for the Church of Sweden at the national level. The overall target return is three per cent per annum above inflation measured in rolling ten-year periods. The model we employ in our asset management to achieve this target consists of the allocation of assets, choice of fund manager and follow-up.

The rate of return target in real terms which was set in 2000 at six per cent per annum, was then lowered to four per cent per annum and has since 2010 been at three per cent per annum.

.png?DoProcessing=&w=800)

Financial development

Performance in 2019 for the Church of Sweden’s asset management on the national level amounted to SEK 1 582 million. This corresponds to a return of 19.1 per cent (benchmark 17.9 per cent). This means that the Church of Sweden’s asset management surpassed its benchmark for the eighth year in a row.

The market value of our portfolio assets, as of 31 December 2019, amounted to SEK 9 626 million (previous year SEK 8 295 million). In December, a withdrawal of SEK 250 million from the portfolio at the Church of Sweden’s national level was made for the purposes of liquidity management.

Performance and returns in the longer perspective

Included in the commission from the Central Board of the Church of Sweden is measuring performance during a rolling ten-year period.

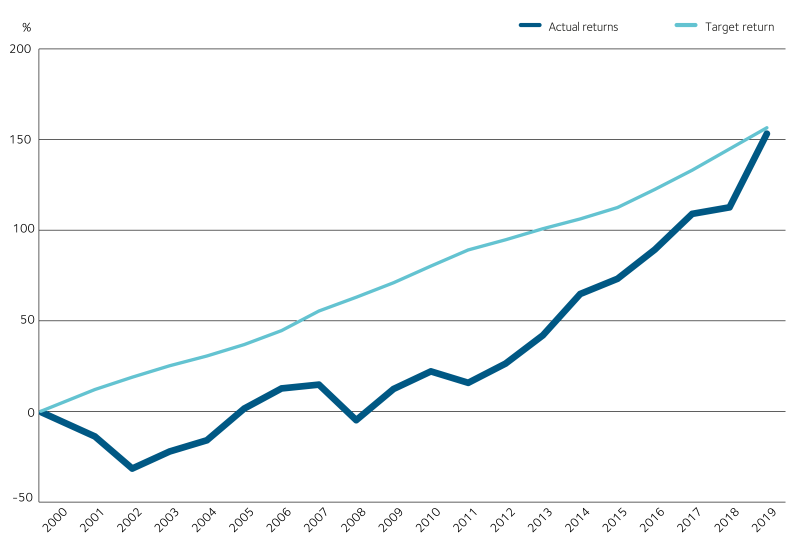

During the period 2010 - 2019 accumulated returns were 125.3 per cent, corresponding to 8.5 per cent per annum. The target return for the same period was 49.9 per cent corresponding to 4.1 per cent per annum. The graph below illustrates this.

Diagram 1 - Actual returns, target return and inflation

.png?DoProcessing=&w=800)

Thanks to vigorous development during the past few years, since the beginning of 2000 returns have almost caught up to the rate of return target for the same period. Asset management was taken over at the turn of the century. Accumulated, returns under management since 2000 have been 153%, corresponding to 4.8 per cent per annum. The target return for the corresponding period was 156 per cent. The years 2001, 2002 and 2008 in which the stock market only experienced negligible growth account for the low returns during the previous decade.

Diagram 2 - Target return and actual returns since the beginning of the period

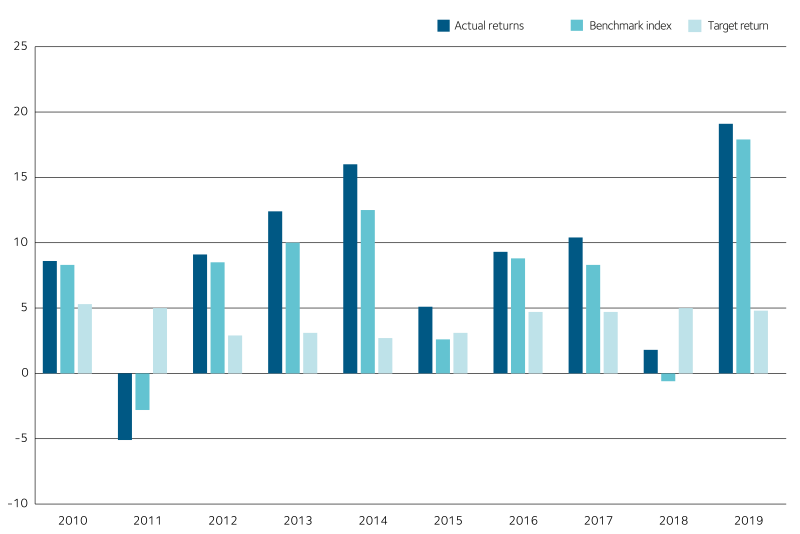

Real annual return, i.e. when inflation is accounted for, was 7.3 per cent on average during this period. The outcome for individual years, as we know however, can vary widely.

Diagram 3 - Target return, actual returns and benchmark index

Performance and returns 2019

Performance in 2019 including bank and management fees amounted to SEK 1 582 million (SEK142.9 million the previous year) Returns for the overall portfolio amounted to 19.1 per cent (1.8 percent). This is 1.2 percentage points better than our benchmark index and 14.3 percentage points higher than the real rate of return target.

This is also the eighth year in a row that returns have exceeded the weighted reference portfolio’s returns. Excess returns in relation to the index are entirely attributable to the overweight in equities of between six and nine percentage points during the year as compared to the reference portfolio.

Allocation based upon a strategic reference portfolio

To create pre-requisites making it possible to achieve the long-term target we use a strategic reference portfolio that we then also use as a reference portfolio when evaluating our asset management against the ten-year time horizon.

We continuously alter the allocation of different asset classes in our portfolio based upon how markets develop.

Equity management

Equity management contributed with SEK 1 407.7 million. Three of the seven asset managers exceeded their benchmark indices net after fees. Ethos aktiefond (equity fund) that is managed by SEB yielded the highest return at 37.0 per cent (index 35.0 per cent). The next highest was Ethos aktiefond (global equity fund) that is managed by RobecoSAM and yielded a return of 35.0 per cent (index 34.4 per cent). As a group, asset managers within the Swedish equities and global asset classes were seen as being on par with their individual benchmark indices. Emerging Markets managers, however, were 6.4 percentage points lower that their index as opposed to the previous year in which they were 6.5 percentage points above the index.

Fixed income investments

The Swedish fixed income investments yielded 1.6 per cent in returns which is 0.5 percentage points higher than the index. The corporate bonds fund yielded 9.4 per cent which is 2.8 percentage points better than the index.

Real estate

This asset class contributed with a 10.8 per cent return. However, this return is largely based on annual external valuations of the various real estate funds that we have invested in. These valuations are made annually but are often presented well into the first quarter, which is why we get a lag of one year in valuation development. The return in the 2019 results therefore includes the valuation as of 31 December 2018.

Alternative investments

Alternative investments yielded a return of 5.9 per cent which is somewhat higher than the benchmark index which yielded 5.0 per cent. As previously mentioned, however, the running valuation of primarily the equity investments, and to a large extent also the illiquid assets, are often associated with a considerable degree of uncertainty. As in previous years, it is mainly SEB's Microfinance funds that contributed to a steady, running return within this asset class. In most of the other holdings one has to wait until maturity before result can be determined.

Diagram 4 - Division between asset classes 31 December 2019

.png?DoProcessing=&w=800)

Table 1 - Result and return 2019 per asset class and a five-year overview

Table 2 - Our largest holdings in equities 2019

Some Sustainability Perspectives from 2019

International influence on sustainable investments

For a number of years, the Church of Sweden has worked to promote investments in clean water and sustainable cities through the investment network, Swedish Investors for Sustainable Development (SISD) whose aim is to further investment within the UN 17 Sustainable Development Goals. Find out more about SISD here.

Last year, The UN General Secretary saw the potential of a corresponding international network and today there is the Global Investors for Sustainable Development (GISD) with some of the world’s largest investors participating as members. GISD’s aim is to create sustainable investment products primarily in developing nations. The Church of Sweden is an active participant in the Swedish reference group.

Two-degree target investments

To confirm that the Church of Sweden’s investments in equities and corporate bonds are in line with the Paris Agreement’s aims, an independent scenario analysis was carried out using the Paris Agreement Capital Transition Assessment (PACTA) software tool.

As last year, the analysis of the climate-risk in our portfolio showed that the risks of not reaching the two-degree target are very low. This is primarily due to the fact that almost none of the companies in the seven sectors that are included in the analysis and run the greatest risks of negatively impacting the economics of climate change and the conversion to a low carbon or fossil free society are included in our portfolio. This primarily concerns companies in sectors such as oil, gas, coal as well as power generation, steel, cement and vehicles as well as marine traffic.

Portfolio holdings:

Green for Growth Fund

During the year, our three-year investment of €10 million in the fixed income fund, Green for Growth, matured. This fund is supported by the EU as well as others and lends money to banks in 17 countries, e.g. Kosovo, the Ukraine and Egypt. These banks in turn lend the money to companies and households that want to replace the fossil-energy they use with renewable energy sources thus drastically reducing their use of energy.

The fund’s investments amount to about SEK 5 million and on the average have reduced emissions of carbon-dioxide in the projects financed by about 50 per cent.

The fund’s activities also include an educational programme in which more than 4 500, mostly private individuals and small companies, have learned about how they can reduce their impact on the climate. Read more here.

SEB Microfinance

At year’s end our investment in SEB’s micro-finance funds totalled SEK 410 million. The funds lend money to different micro-financing institutes in developing countries. These institutes in turn lend money to people with low or no income and who cannot borrow money from the usual assortment of banks. With these modest amounts of money, people can buy, e.g. a pig or a sewing machine which establishes a base for their own businesses. With the support of these small loans they have the opportunity to increase their income. In this way, many women have received the opportunity to improve their incomes, lift themselves out of poverty and have also had the opportunity to pay for a higher education for their children.

Thule Buyout Co-Investment Fund I

At the conclusion of 2019, an investment in Thule Buyout Co-investment Fund I was made. The fund offers investors the opportunity to invest, in parallel with Skandia, in funds that consist of unlisted companies in the USA and Europe. That is to say, investments are made in shares that are not listed on any stock market, so called private equity. All of the fund’s companies go through a norm-based screeningby Skandia’s ESG Due Diligence team.

About our sustainable investments

All activities of the Church of Sweden are permeated by long term thinking and sustainable development for humans and the environment.

The policy is based upon two fundamental values: the principle of human dignity and the concept of stewardship as reflected in international environmental and human rights conventions and existing frameworks for responsible business. Based upon these two principles, asset management complements other efforts towards sustainable development within the Church of Sweden.

Download our financial policy.